A Pandemic Update on Trending Search Terms

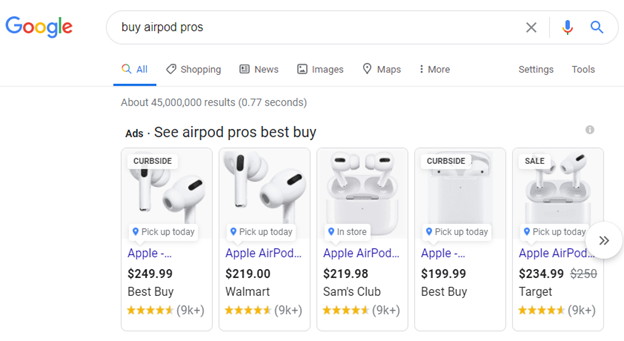

Last year changed a lot in retail – with limited capacities at stores due to COVID-19, retailers started pushing for more online driven marketing and focused on store pickups. Google introduced the Curbside Pickup tag (see image below) earlier in the year, with Microsoft following shortly after. Retailers began to train their customers to shop online more than ever before.

For many marketers, this is something that we could anticipate. More people have smartphones, internet speeds are getting faster, more retailers build apps and people want products now.

During a call with a client, we discussed how beneficial it is to buy online and pick up in store, or at least be able to view if the product is in stock so you don’t waste a trip out. In 2020, going to the store was a higher risk than the previous year, meaning you could be exposing yourself to COVID and not even get the product you went in for.

The Height of Lockdown

In late Q1 Nils Rooijmans shared a script in the PPC community that showed search queries trending this year compared to the previous week and the previous year. Looking at search trends this way showed how much user behavior had shifted early on in the pandemic – especially with one of my clients who saw an increase coming from household products. This also led to more users using “buy online, pick up in store,” which I was able to set through Smart Shopping with Local Inventory Ads and the Curbside Pickup Tag. I saw insanely strong results from this script early on, which you can read more about here.

When I wrote my post in July, I had already been running the script and Smart Shopping strategy for a few months. From the beginning, I knew this campaign was not one and done. Throughout 2020, I reviewed the search queries and compared to the products in GMC weekly and updated SKUs to increase revenue on these trending queries – 4,500% to be exact.

Why Keep Using It?

Having search terms in one sheet, especially since you can’t view search terms in Smart Shopping, rather than spread across multiple campaigns based on segmentation (product type or geos), I was able to push budgets toward one campaign that housed products that saw the highest volume and potential for return, rather than having to manually change those segmented campaigns budgets.

As I saw earlier in the year, using the script allowed me to capitalize on search trends and the mass volume differences year over year and continue to push revenue with more competition on products – especially later in the year for product types such as lawn and garden and holiday decorations.

In Q2, the height of the pandemic, most queries revolved around toilet paper, paper towels and other household essentials. This was a competitive time but also led to the highest revenue and ROAS from the campaign.

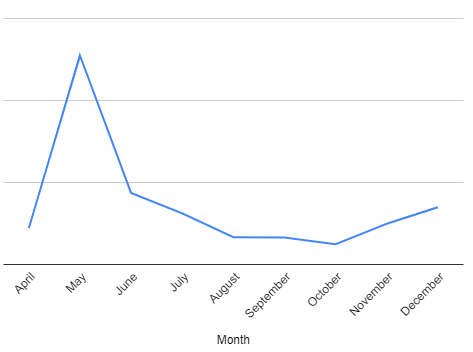

In the chart below, you can see how revenue volume shifted over the summer and back up in Q4. I had expected there to be seasonality differences, especially as the “pandemic items” started to become less in-demand than in Q2.

The thing I hadn’t expected was what items were trending during Q3 and Q4, which without knowing the top trends could have led to lost revenue. In Q3, most search volume generally sways towards lawn and garden products. However, the script showed that there were more searches for sports and outdoor items than the previous year, as well as food preservation items. Q4 was even more surprising in the way that outdoor decorations saw a 2,143% increase from the previous year.

With people spending more time at home, these shifts for specific products makes sense. I could have potentially lost out on revenue, especially if I had stopped using the script when the campaign’s revenue saw a drop from the beginning of the pandemic. However, throughout the whole year this campaign led to $3.6M in revenue that I likely would not have seen if I wasn’t reviewing trending search queries.

Why I’m Still Using the Script in 2021

The growth I saw from the script is still a part of my shopping strategy now. As things in our world can change quickly, I find it extremely important to still see how users’ search behavior changes daily, weekly and from the previous year.

While I mentioned that having the top search terms in one smart shopping campaign was beneficial earlier in my test with this strategy, getting slightly more segmentation could be beneficial. In standard shopping structure, I would have the campaigns split out of locations or product types, however; with the trending search term campaign, I would have less campaigns to adjust budgets for. This allowed me to be able to focus on those top products only, rather than a full product type and in particular geos.

Over the past few weeks, the midwest has been hit with some insanely cold weather (-10 degrees with windchill type cold). While searches for snowblowers and generators would have happened regardless, and I had these products live in a standard shopping campaign, looking at the trending queries script showed that there was a large shift year over year.

When I started to think of the extreme cold, a light bulb exploded in my head – I could set up some additional segmentation to capitalize on these trends and push more towards Local Inventory Ads, which allows me to show that Curbside Pickup Tag. I started pulling out particular locations into their own campaigns based on multiple factors such as weather, seasonality and product type.

For example, I’m able to find specific states that are relevant for products (who buys ice fishing products in Florida?) and make quicker decisions about where to put these trending products rather than blanket target as I did early in the pandemic when everyone was searching for the same items.

Things Aren’t Changing Anytime Soon

Online shopping has changed over the past year, and you’ve probably experienced this yourself. The best way to adjust paid shopping ad strategy is to see how people are searching and what and when they are buying.

Now that I’ve updated the campaign into multiple categories, I’ll follow up later this year to show how it worked (or didn’t).